Investing in vacation rentals in Florida is a lucrative opportunity for those looking to take advantage of the booming tourism industry. With its picturesque beaches, internationally recognized theme parks, and warm climate all year round, Florida has become one of the top vacation destinations in the world, attracting millions of visitors annually.

Consequently, many investors are enticed by the prospect of generating substantial returns through acquiring and managing vacation rentals within this sought-after location. However, while such investments may indeed offer lucrative rewards, it is crucial that potential investors carefully weigh both the advantages and drawbacks before committing their resources.

To make informed decisions regarding investing in Floridian vacation rentals, one must consider various factors, including property acquisition costs, ongoing maintenance expenses, seasonality trends affecting occupancy rates, and revenue generation potential. Furthermore, understanding local regulations governing short-term rentals and accurately assessing market competition will be integral in determining overall profitability.

By examining these critical aspects alongside an individual’s financial goals and risk tolerance levels and acknowledging the inherent desire for a sense of belonging within a community or attractive locale, investors can better position themselves to navigate the dynamic landscape of this unique sector. The following article thoroughly delves into these components and sheds light on the enticing prospects and cautionary considerations associated with these ventures.

Advantages Of Investing In Florida Vacation Rentals

The investment landscape in the vacation rental market, particularly within Florida, presents numerous benefits for potential investors.

One such advantage is the favorable tax climate that exists in this state. The absence of personal income tax and other attractive incentives offered by local governments make owning a vacation rental property more financially rewarding for investors. Furthermore, these Florida tax benefits encourage domestic and international tourists to visit the Sunshine State, increasing demand for vacation rentals.

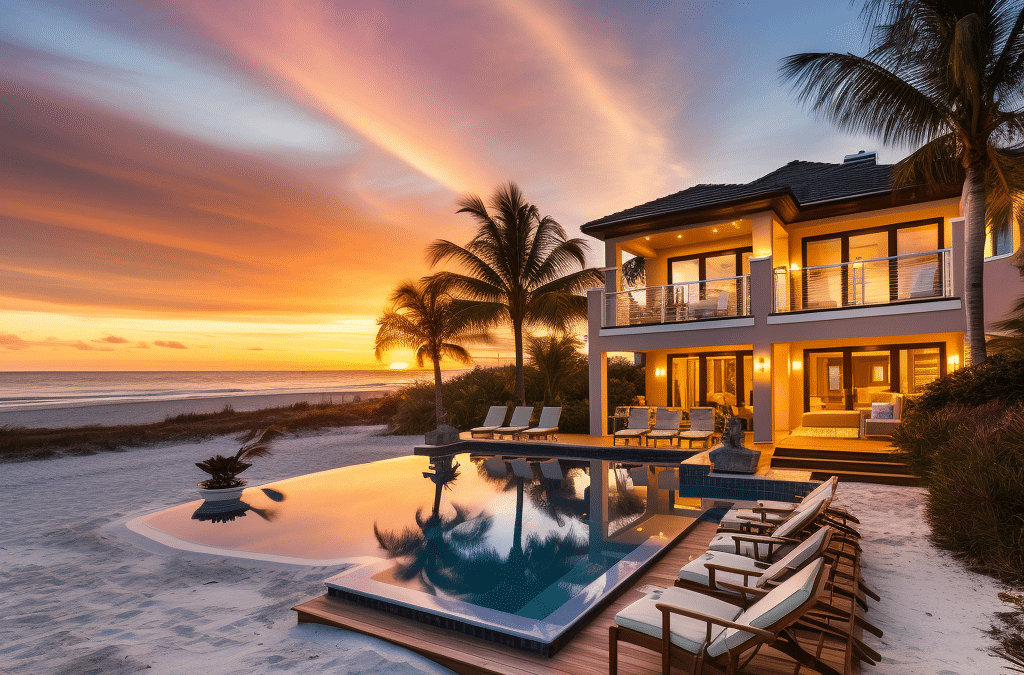

A diverse rental market also sets Florida apart from other states as an ideal location to invest in vacation properties. This diversity stems primarily from the varied geographical offerings that cater to different preferences among renters; some may opt for beachfront homes, while others desire proximity to theme parks or nature reserves. In addition, a mix of urban centers and rural retreats allows guests who value cultural experiences or outdoor adventures to find their perfect getaway destination.

As a result, savvy investors can strategically choose properties catering to specific target markets based on location and amenities provided. In light of these factors, it becomes evident why investing in Florida’s vacation rental industry is an appealing choice for those seeking lucrative returns on their investments.

By leveraging advantages like the lack of state income tax and capitalizing on the dynamic range available within the Florida real estate market, investors can position themselves well amid various consumer trends and tap into evolving demographics eager to experience all these popular tourist destination offers.

Considering these points about opportunities presented by ownership of vacation rentals in Florida, prospective investors should weigh up and explore the drawbacks of these ventures before making informed decisions about where best to allocate resources moving forward.

Some potential drawbacks may include high initial investment costs, seasonal fluctuations in demand, ongoing maintenance and management responsibilities, increased competition in the vacation rental market, potential impacts from natural disasters, and changing regulations and taxation policies.

By carefully evaluating the benefits and challenges associated with vacation rental ownership in Florida, investors can make well-informed decisions that maximize returns and minimize risks in their real estate ventures.

Drawbacks Of Owning Vacation Properties In Florida

As the waves of uncertainty crash against the shores of Florida’s vacation rental market, investors may find themselves navigating through stormy waters. The fluctuating demand for short-term rentals is a constant reminder that not all investments in this sector are guaranteed to provide smooth sailing or financial security.

In recent years, occupancy rates have demonstrated significant variability, with seasonal fluctuations and economic shifts contributing to an unpredictable landscape. Another potential drawback for those considering investing in vacation properties within the Sunshine State is the looming threat posed by hurricane impacts. As history has shown, these powerful storms can wreak havoc on coastal communities and cause extensive damage to property and infrastructure.

For example, Hurricane Irma left over $50 billion in destruction in 2017 alone. With climate change increasing the frequency and intensity of hurricanes, investors must weigh the risks associated with owning property in areas prone to natural disasters when deciding whether or not to venture into Florida’s vacation rental market.

Taking heed of the metaphorical waves mentioned earlier, it becomes clear that prospective investors should remain aware of both potential risks and rewards associated with owning vacation properties in Florida before making any decisions. Moving toward assessing costs and maintenance expenses involves conducting thorough research and understanding one’s risk tolerance. This will allow individuals to make informed choices about whether investing in Florida’s vacation rental market aligns with their financial goals while fostering a sense of belonging within this vibrant community.

Assessing Costs And Maintenance Expenses

Despite the drawbacks mentioned in the previous section, investing in vacation rentals in Florida can still be a viable financial opportunity. Potential investors must weigh these challenges against the possible rewards to make an informed decision. A critical factor in determining whether or not this investment will yield positive returns lies in conducting a thorough cost evaluation and implementing effective expense management strategies.

When examining costs associated with owning vacation properties, investors should consider several expenses:

- The initial purchase price includes the property’s value, closing fees, taxes, and other related charges.

- Ongoing maintenance costs encompass routine upkeep such as landscaping and cleaning services and emergency repairs or replacements that may arise over time.

- Management fees: If employing a professional property management company to handle bookings, guest communications, and overall maintenance, investors must account for their costs, which typically range from 20% to 30% of rental income.

- Insurance premiums: Given Florida’s susceptibility to hurricanes and flooding, insurance coverage is essential yet often expensive.

A comprehensive understanding of these outlays allows investors to gauge if they are prepared for expected and unexpected expenditures linked to their vacation rental investments. Furthermore, developing expense management techniques such as creating budgets based on projected revenues and setting aside funds for anticipated annual maintenance needs can help alleviate financial stressors while maximizing returns.

Navigating through costs and expenses is just one piece of the puzzle when exploring investment opportunities within Florida’s competitive vacation rental market. The following section delves into another critical aspect – navigating local regulations and competition – guiding how prospective owners can position themselves advantageously amidst various industry dynamics.

Navigating Local Regulations And Competition

Navigating the complex landscape of local regulations and competition in Florida’s vacation rental market can be daunting. However, understanding these intricacies is vital for potential investors to maximize their returns while minimizing risk exposure.

One critical aspect to consider is identifying regulation loopholes that may allow for greater flexibility in property management, such as zoning restrictions or permitting requirements. Knowledgeable investors can leverage these opportunities by acquiring properties strategically positioned within areas less constrained by regulatory burdens.

Analyzing competitive trends also plays a significant role in informed decision-making regarding investment in Florida vacation rentals. A thorough examination of supply and demand dynamics, pricing strategies employed by competitors, and overall market saturation levels will aid prospective investors in evaluating the viability of specific locations and property types.

By closely monitoring fluctuations in both short-term and long-term rental markets, astute financial advisors can guide on leveraging prevailing industry conditions to optimize investment outcomes. Thoughtful consideration should be given not only to the current state of the marketplace but also to its anticipated evolution over time; this involves continually assessing competitor activity, changes in consumer preferences, and technology advancements affecting property management efficiencies, among other factors.

Through continuous evaluation of these elements alongside evolving personal financial circumstances, it becomes feasible for investors to adapt their approach accordingly to achieve sustainable success in Florida’s vacation rental sector. This comprehensive analysis allows for a seamless transition into exploring how best to balance one’s financial goals and risk tolerance when venturing into this dynamic investment arena.

Balancing Financial Goals And Risk Tolerance

Astonishingly, Florida attracts over 130 million tourists each year. This influx of visitors provides an excellent opportunity for investors to capitalize on the demand for vacation rentals in the region. However, balancing financial goals and risk tolerance is crucial before making any investment decision. Risk management plays a significant role in determining whether investing in vacation rentals aligns with one’s overall investment objectives.

Diversification benefits can be achieved by incorporating vacation rental properties into an existing portfolio of investments. These properties can act as alternative income streams relatively uncorrelated with traditional asset classes such as stocks and bonds. Moreover, given that tourism in Florida remains consistently high throughout various market cycles, there may be less volatility associated with these types of investments than more conventional options.

Nevertheless, prospective investors should consider maintenance costs, property taxes, insurance premiums, and seasonal fluctuations when assessing the potential risks and rewards.

To ensure optimal returns while mitigating potential risks, investors should conduct thorough due diligence on individual properties within their desired location(s). Factors to consider include proximity to popular tourist attractions or amenities, average nightly rates for comparable units in the area, occupancy levels during peak seasons versus off-peak periods, and historical trends concerning local real estate values.

By conducting comprehensive research before purchasing a vacation rental property in Florida, individuals can make informed decisions tailored towards achieving both short-term cash flow needs and long-term capital appreciation aims—all while managing exposure to potentially unfavorable market conditions through prudent risk assessment techniques.

Frequently Asked Questions

How Does The Seasonality Of Florida’s Tourism Industry Impact Vacation Rental Income And Occupancy Rates Throughout The Year?

The seasonality of Florida’s tourism industry significantly impacts vacation rental income and occupancy rates throughout the year, necessitating strategic planning for investors to optimize returns.

Seasonal pricing adjustments can be effectively employed during peak travel periods, such as holidays and summer, when demand is high, to capitalize on increased tourist interest in accommodations.

Conversely, offering off-peak promotions targeting travelers seeking value propositions may help maintain consistent occupancy levels during less busy seasons.

By understanding and proactively adapting market strategies surrounding these fluctuations in visitor traffic, investors in Florida vacation rentals can better position themselves to maximize their property’s revenue potential while fostering a sense of belonging among guests who enjoy this popular destination year-round.

What Are Some Effective Marketing Strategies For Attracting Guests To My Florida Vacation Rental Property?

Effectively marketing a Florida vacation rental property involves implementing strategies to attract and retain guests while maximizing occupancy rates.

Guest incentives, such as discounted stays for return visits or referral rewards programs, can foster loyalty and encourage satisfied visitors to become advocates of the property.

Social media promotions, including visually appealing images showcasing the amenities of the rental and its surroundings, allow potential renters to envision themselves enjoying their stay at the location.

Additionally, partnering with local businesses or tourism boards may provide opportunities for cross-promotion and tapping into an existing audience interested in traveling to the area.

By adopting these tactics, investors in Florida’s vibrant vacation rental market could increase their overall returns by creating a more consistent demand from new and returning guests.

How Do I Determine The Ideal Location For Investing in Vacation rentals in Florida? Considering Factors Like Proximity To Attractions, Local Amenities, And Potential Rental Demand?

In determining the ideal location for a vacation rental investment in Florida, it is crucial to consider factors such as proximity to attractions, local amenities, and potential rental demand.

To mitigate Florida investment risks and manage rental property expenses effectively, investors should analyze locations with high tourist appeal, encompassing popular theme parks or beach destinations.

Furthermore, selecting areas boasting robust infrastructure – including access to quality dining options, shopping centers, and transportation networks – can enhance guests’ overall experience and encourage repeat visits.

Conducting thorough market research on occupancy rates and pricing trends within targeted regions further empowers savvy investors to identify lucrative opportunities that cater to prospective renters’ preferences while fostering a sense of belonging within these sought-after locales.

What Are Some Common Challenges Faced By Vacation Rental Property Owners In Florida, Such As Dealing With Property Management Or Addressing Guest Complaints, And How Can I Prepare For Them?

Studies have shown that over 50% of vacation rental owners feel overwhelmed by property management responsibilities.

In Florida, common challenges these individuals face include hurricane preparedness and insurance considerations.

To address such obstacles, investors must develop a comprehensive plan covering proactive measures – such as installing storm shutters or investing in flood-resistant materials – and reactive steps like maintaining an emergency fund for potential damages incurred during hurricane season.

Additionally, securing appropriate insurance coverage for the unique risks associated with vacation rentals can mitigate financial impacts from unforeseen events.

By preparing adequately for these challenges and engaging with local resources, investors may create a sense of belonging within the community while ensuring their property remains profitable and attractive to future guests.

How Can I Ensure My Vacation Rental Property In Florida Remains In Compliance With Local, State, And Federal Tax Requirements?

To ensure tax compliance and adherence to rental regulations for a vacation property in Florida, one must familiarize oneself with local, state, and federal tax requirements.

Key steps include registering the property as a business entity, obtaining required licenses and permits, collecting and remitting applicable taxes such as sales tax and tourist development tax (TDT), and maintaining accurate records of all financial transactions associated with the property.

Additionally, staying informed about changes in legislation or regulatory requirements can help mitigate potential risks and maintain long-term viability within the competitive vacation rental market.

Engaging a knowledgeable accountant or legal expert specializing in this niche industry may prove invaluable in navigating complex taxation guidelines while fostering a sense of security through professional guidance.

Conclusion

In conclusion, investing in vacation rentals within the Sunshine State presents a double-edged sword. On the one hand, Florida’s thriving tourism industry provides ample opportunity for consistent rental income; however, navigating the challenges of seasonality and property management can create potential pitfalls.

Investors must carefully consider location, marketing strategies, and regulatory compliance to reap the benefits while minimizing risks.

In essence, acquiring a successful vacation rental investment in Florida is akin to solving an intricate puzzle. Each piece is crucial in forming a complete picture that leads to profitability and long-term success.